The Indian packaging industry stands at a pivotal transformation point. With the sector projected to reach ₹2.3 trillion by 2025, manufacturers are increasingly investing in advanced automation technologies to stay competitive. From AI-driven predictive maintenance to sustainable packaging solutions, the landscape is evolving rapidly—and companies that fail to adapt risk being left behind. As an industry expert who has witnessed the remarkable growth of packaging automation in India, I’ve identified 10 critical technology areas that are reshaping how manufacturers approach efficiency, sustainability, and profitability. This comprehensive guide addresses the most pressing challenges facing Indian packaging manufacturers today and provides actionable insights for technology adoption

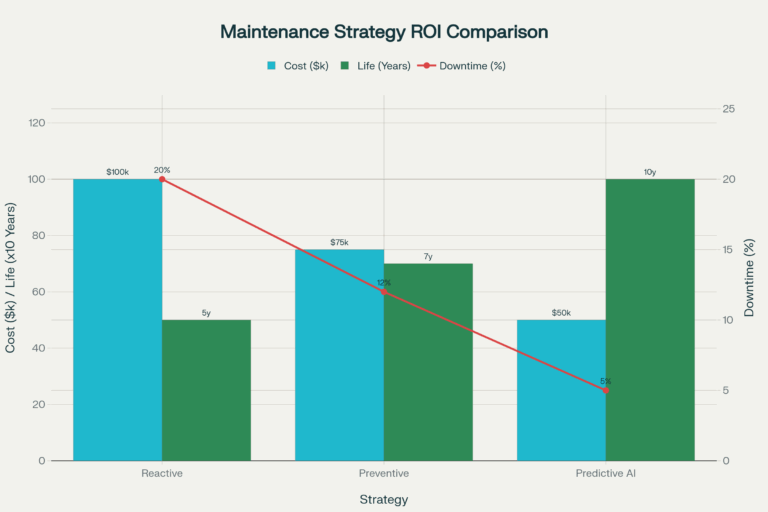

The chart titled Maintenance Strategy ROI Comparison clearly demonstrates the financial and operational benefits of evolving from reactive to more proactive maintenance approaches. The Reactive strategy, while the least planned, incurs the highest Cost at $100k and results in the shortest equipment Life at 5 years and the highest Downtime at 20%. Stepping up to a Preventive strategy immediately shows an improved return, dropping the cost to $75k, extending life to 7 years, and cutting downtime to 12%. The most substantial gains are realized with the Predictive AI strategy, which achieves the lowest Cost at $50k, maximizes equipment Life to 10 years, and minimizes operational Downtime to just 5%. This data powerfully illustrates that the initial investment and effort required for advanced planning and technology, particularly with Predictive AI, yields significantly better performance and a higher overall Return on Investment.

Traditional maintenance approaches are bleeding Indian manufacturers dry. Unplanned downtime alone costs the manufacturing sector over ₹2,000 crores annually, with packaging lines particularly vulnerable due to their high-speed, continuous operations. Consider this: A typical VFFS machine operating at 150 bags per minute loses approximately ₹45,000 in revenue for every hour of unplanned downtime. Multiply this across multiple machines and shifts, and the financial impact becomes staggering.

Modern predictive maintenance systems deliver remarkable ROI: Studies show that AI enabled predictive maintenance can reduce unplanned downtime by up to 40% while cutting maintenance costs by 1560%. For Indian packaging manufacturers, this translates to: Reduced Equipment Failures: Early detection prevents 85% of catastrophic breakdowns Real-World Implementation Strategy Leading Indian packaging companies are deploying IoT sensors to monitor: Vibration patterns in filling machines and sealers Temperature fluctuations in heat-sealing systems Motor current signatures in conveyor systems Hydraulic pressure variations in press operations Extended Equipment Life: Assets last 2040% longer with proactive care Optimized Labor: Maintenance teams focus on value-adding activities rather than emergency repairs

Leading Indian packaging companies are deploying IoT sensors to monitor:

Extended Equipment Life: Assets last 2040% longer with proactive care

Optimized Labor: Maintenance teams focus on value-adding activities rather than emergency repairs

Case Study: A Mumbai-based flexible packaging manufacturer implemented predictive

maintenance across their VFFS lines and achieved 23% reduction in maintenance costs while

improving OEE from 76% to 89% within 18 months.

Most Indian manufacturers make the costly mistake of focusing solely on equipment purchase price. However, the initial cost represents less than 10% of total lifetime expenses. The remaining 90% includes energy, maintenance, labor, and downtime costs—areas where smart investments yield exponential returns.

Energy Consumption: Packaging equipment typically consumes 15-25% of a facility’s total energy. Modern servo-driven systems reduce energy consumption by 30-50% compared to pneumatic alternatives.

Material Waste: Poor equipment calibration leads to 15-20% material waste. Advanced packaging machines with precision controls reduce this to 3-5%, saving significant costs in high-volume operations.

Labor Inefficiencies: Manual interventions, changeover delays, and quality issues inflate labor costs. Automated systems with quick-changeover capabilities reduce labor requirements by 40-60%

For Indian packaging manufacturers, a comprehensive TCO analysis should include:

Initial Investment (10-15% of total cost)

Operating Costs (35-40%): Energy, materials, labor

Maintenance (20-25%): Preventive, predictive, emergency repairs

Downtime Impact (15-20%): Lost production, overtime, expedited shipping

End-of-Life Value (5-10%): Resale, recycling, disposal costs

ROI Calculation Example: A ₹50 lakh automated packaging line with 8% annual maintenance costs but 35% higher efficiency will break even within 2.5 years compared to manual operations, considering labor savings and reduced waste.

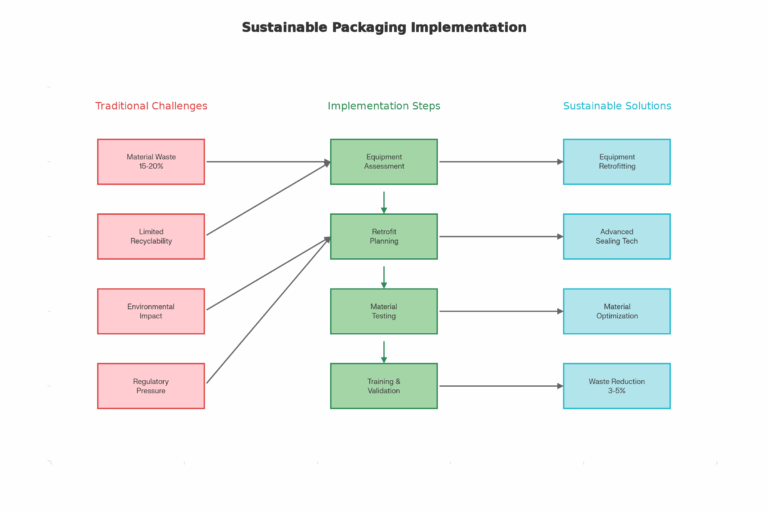

India’s push toward sustainable packaging is accelerating, driven by consumer awareness and regulatory pressure. However, processing biodegradable and compostable materials on existing VFFS equipment presents unique technical challenges.

Sealing Temperature Sensitivity: Bioplastics often require narrower temperature ranges (±2°C) compared to conventional films (±5°C). This demands precise thermal control systems.

Film Handling Characteristics: Biodegradable films may be:

Stiffer and less flexible, affecting forming operations

More susceptible to tearing, requiring gentler handling

Moisture-sensitive, demanding climate-controlled environments

Modern VFFS machines can be adapted for sustainable materials through:

Advanced Sealing Jaws: Temperature-controlled systems with precise heat distribution.

Film Tension Control: Servo-driven unwind systems prevent material damage.

Modified Cutting Systems: Laser cutting reduces material waste by 3% compared to mechanical cutting.

Enhanced Controls: Recipe-based systems store optimal parameters for different materials.

Implementation Timeline: Most VFFS retrofits for bioplastics can be completed in 2-4 weeks with minimal production disruption.

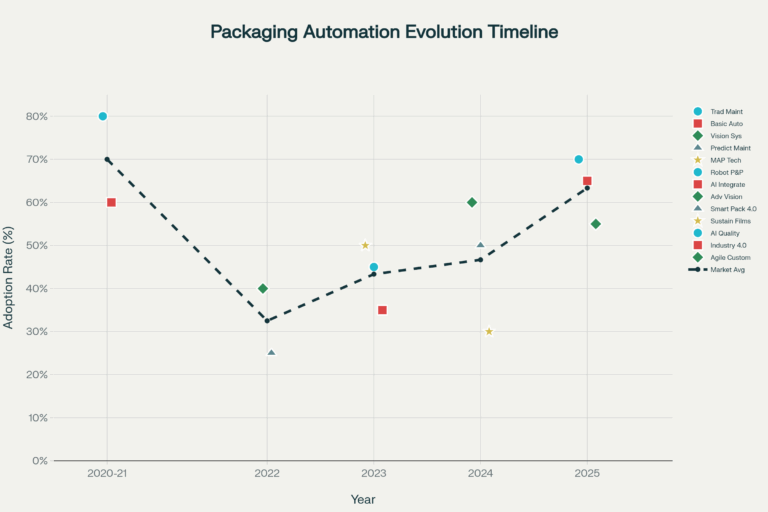

Packaging 4.0 represents the integration of cyber-physical systems, IoT, cloud computing, and cognitive computing into packaging operations. For Indian manufacturers, this isn’t just about technology—it’s about survival in an increasingly competitive global market.

Modern AI systems excel at:

Real-time defect detection with 99.9% accuracy

Predictive quality management based on process parameters

Adaptive process control that self-optimizes based on feedback

Vision System Integration: AI-powered cameras inspect up to 2,000 products per minute, detecting defects invisible to human operators while maintaining detailed quality records for traceability.

Leading Indian packaging companies are implementing digital twins to:

Simulate equipment performance before physical changes

Optimize production schedules based on real-time demand

Predict maintenance requirements with 95% accuracy

Companies implementing Packaging 4.0 solutions report:

20% improvement in productivity within 6 months.

15% reduction in quality defects through AI-driven control.

25% decrease in changeover times via digital optimization

Indian packaging manufacturers face an acute skilled labor shortage, with 68% reporting difficulty finding qualified operators. Robotic pick-and-place systems offer a strategic solution, providing consistent performance while addressing workforce challenges.

Delta Robots: Ideal for high-speed applications (120-140 picks/minute), priced from ₹15-25 lakhs

SCARA Robots: Perfect for precise positioning tasks, offering ±0.025mm repeatability at ₹8-15 lakhs

Collaborative Robots: Safe human-robot interaction, starting at ₹6-12 lakhs with integrated vision systems

Successful robotic integration requires:

Application Assessment: Determine optimal robot type based on cycle time, payload, and precision requirements

End-Effector Selection: Custom grippers designed for specific products (suction, mechanical, magnetic)

Vision Integration: 2D/3D cameras for product recognition and positioning

Safety Systems: Light curtains, emergency stops, and collaborative features

Typical payback periods:

High-volume applications: 12-18 months

Medium-volume operations: 24-36 months

Flexible manufacturing: 18-30 months

Hidden benefits include: Improved consistency, reduced worker compensation claims, and ability to handle multiple SKUs without retraining.

When evaluating VFFS machines for Indian operations, prioritize these factors:

Speed and Flexibility: Modern machines achieve 200+ bags per minute while handling multiple product formats

Modular Design: Systems that accommodate future expansion and product diversification

Energy Efficiency: Servo-driven systems reduce power consumption by 30-40% compared to pneumatic alternatives

Standard VFFS Systems:

Fixed forming tubes

Manual changeovers (30-60 minutes)

Basic HMI controls

85-90% efficiency rates

Advanced VFFS Systems:

Quick-change forming tubes (5-15 minutes)

Recipe-driven automation

Integrated vision systems

95-98% efficiency rates

Key vendor assessment criteria:

Local Service Support: Response time <24 hours for critical issues

Spare Parts Availability: 95% availability within 48 hours

Training Programs: Comprehensive operator and maintenance education

Technology Roadmap: Future upgrade compatibility

India’s MAP equipment market is growing at 6.0% annually, driven by cold chain development and food safety regulations. For manufacturers, MAP technology offers significant competitive advantages through extended shelf life and reduced food waste.

Product-Specific Gas Mixtures:

Fresh Meat: 25-45% CO₂, balance nitrogen (extends shelf life 200-400%)

Dairy Products: 20-30% CO₂ for bacterial inhibition

Ready Meals: Custom blends based on pH and moisture content

MAP System Types:

Tray Sealers: ₹8-45 lakhs, ideal for portion control

Thermoforming Systems: ₹25-80 lakhs, high-volume operations

Horizontal Flow-Pack: ₹15-35 lakhs, flexible applications

MAP investment justification:

Reduced Spoilage: 14-18% decrease in product returns

Extended Distribution: Access to distant markets through longer shelf life

Premium Pricing: 8-12% higher prices for fresh, preservative-free products

Payback Period: Typically 24-36 months for medium-scale operations, 18-24 months for high-volume facilities

Indian consumers increasingly demand personalized products, with 73% willing to pay premium for customized packaging. Agile packaging systems enable manufacturers to respond quickly to market trends while maintaining operational efficiency.

Recipe-Based Controls: Store parameters for unlimited SKUs, enabling changeovers in under 15 minutes

Servo-Driven Adjustability: Real-time modifications without manual intervention

Modular Design: Interchangeable components for different package formats

Successful agile packaging requires:

Demand Forecasting: AI-driven analytics to predict SKU requirements

Inventory Optimization: Just-in-time material management

Operator Training: Multi-skill development for system flexibility

Quality Systems: Consistent standards across all variants

Companies implementing agile packaging report:

35% faster time-to-market for new products

20% increase in customer satisfaction through customization

15% improvement in inventory turnover via demand responsiveness

India’s plastic ban and extended producer responsibility regulations are forcing rapid adoption of sustainable packaging materials. By 2025, 35% of packaging must contain recycled content, making retrofitting existing equipment a critical investment.

Equipment Evaluation Criteria:

Age and Condition: Machines under 10 years are prime retrofit candidates

Control System Compatibility: Modern PLCs enable

Mechanical Suitability: Frame strength

Common Modifications:

Sealing System Updates: Temperature-controlled jaws for sensitive materials

Film Handling Improvements: Tension control and edge guidance systems

Cutting Technology Upgrades: Laser systems for clean edges and reduced waste

Retrofit Investment: Typically 15-25% of new equipment cost

Alternative Costs: New sustainable-capable equipment costs 100% of retrofit investment

ROI Timeline: Most retrofits pay for themselves within 18-36 months through material savings and regulatory compliance

Advanced vision systems reduce quality defects by 90% while enabling real-time process optimization. For Indian manufacturers competing on quality and efficiency, vision integration is becoming essential.

2D Vision Systems excel at:

Label verification and positioning

Barcode and text reading

Surface defect detection

Color and pattern matching

3D Vision Systems enable:

Volume and height measurements

Complex shape analysis

Bin picking and robot guidance

Complete product profiling

Successful vision implementation requires:

Lighting Design: Consistent, controlled illumination for reliable detection

Camera Positioning: Optimal angles for complete inspection coverage

Processing Speed: Real-time analysis matching line speeds

Rejection Systems: Automated removal of non-conforming products

Vision system benefits:

Quality Cost Reduction: 60-80% decrease in customer complaints

Labor Savings: 70-85% reduction in manual inspection requirements

Throughput Improvement: 15-25% increase through continuous operation

Conduct comprehensive TCO analysis across all equipment

Implement basic predictive maintenance on critical assets

Assess current equipment for sustainable material compatibility

Establish baseline metrics for productivity and quality

Deploy AI-powered quality control systems

Retrofit high-value equipment for sustainable materials

Implement robotic pick-and-place in bottleneck areas

Upgrade to advanced VFFS systems for core products

Complete Industry 4.0 integration across all lines

Deploy agile packaging systems for customization

Implement MAP technology for premium products

Achieve full vision-guided quality control

Established in 1998, AmarPack Machines Pvt. Ltd. represents over 25 years of innovation and excellence in packaging machinery manufacturing. The company has evolved from a small-scale operation to become a trusted name across industries, serving customers throughout India and internationally. This quarter-century journey reflects consistent commitment to quality, innovation, and customer satisfaction.

AmarPack specializes in a complete range of packaging solutions including shrink wrapping machines, vacuum packaging systems, continuous band sealers, L-sealer shrink tunnel machines, and filling equipment. The company’s product diversity enables one-stop shopping for packaging requirements across multiple industries. Each product line incorporates latest technologies and industry-specific features.

AmarPack’s machines serve diverse industries including FMCG, pharmaceuticals, cosmetics, food processing, and chemicals. The company’s reputation for reliability, durability, and performance has earned trust across these demanding sectors. Customer testimonials consistently highlight machine longevity, consistent performance, and excellent after-sales support.

With exports spanning multiple continents, AmarPack demonstrates commitment to international quality standards and customer service. The company’s global presence reflects its capability to meet diverse market requirements while maintaining consistent quality across different operating environments. Export success validates the company’s technological competence and manufacturing excellence.

Founded in 1998 in Mumbai, India, AmarPack Machines Pvt. Ltd. is one of India’s leading manufacturers and exporters of premium packaging machines. Read More

GST No. 27AAZCA2345J1Z6

Get a quick quote from our experts. Fast response guaranteed!